value appeal property tax services

Search Any Address 2. How much effort you decide to put into a challenge.

Property Assessment Assessment Search Service Frequently Asked Questions

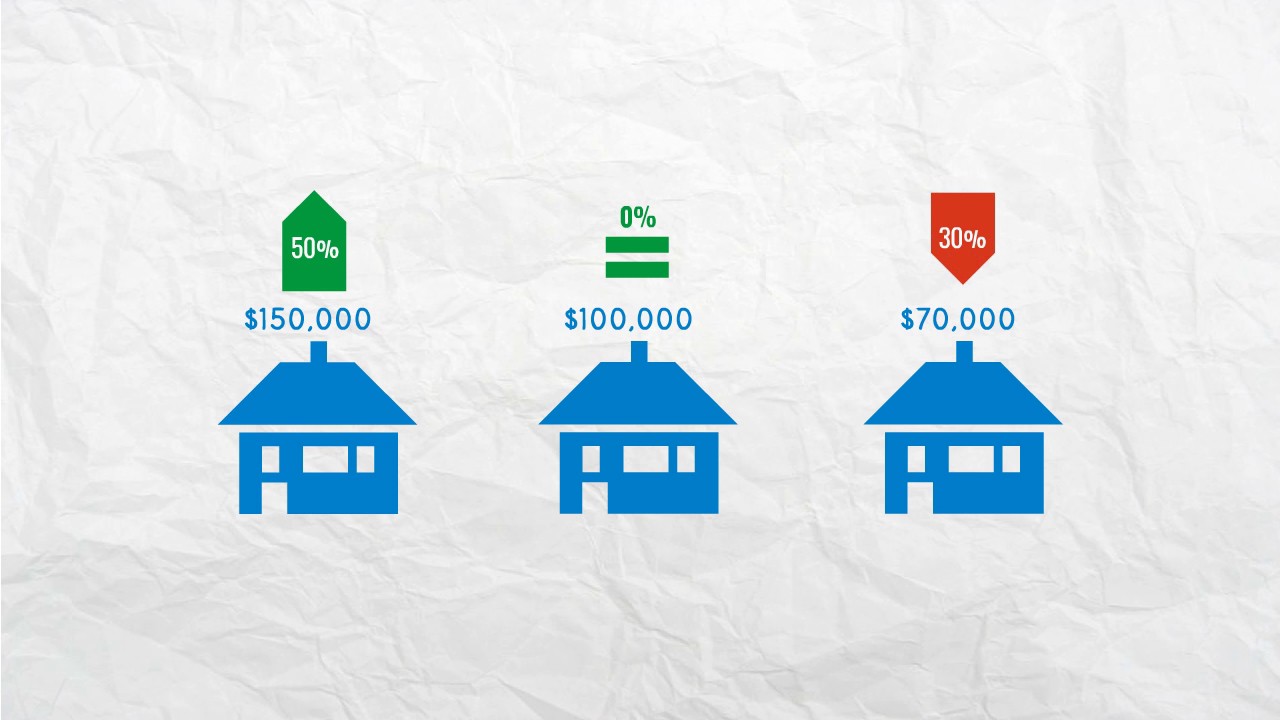

Following is a table click on link for Chapter 123 Table you can use to determine your estimated market value and the Common Level Range for your property examples are for illustrative.

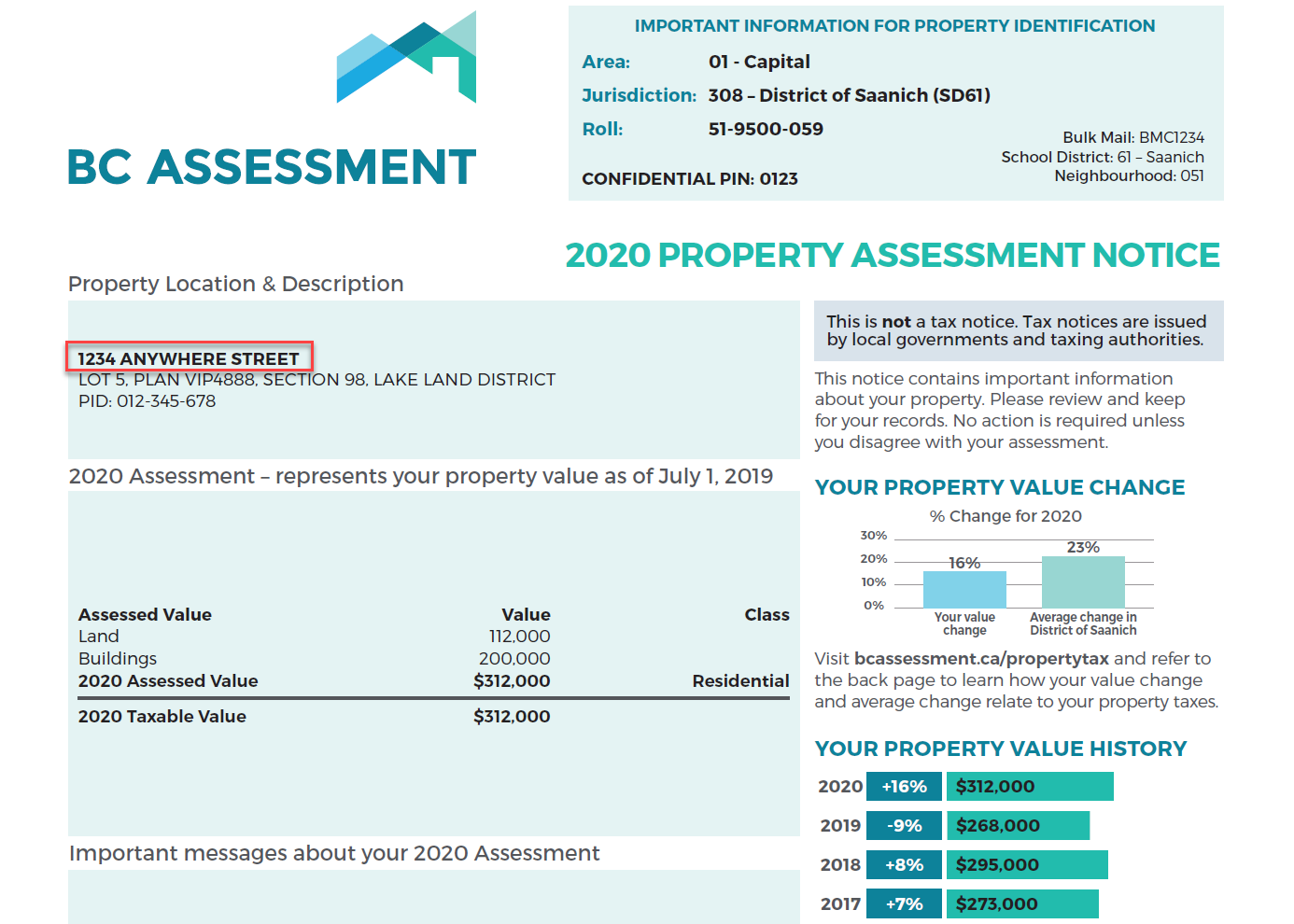

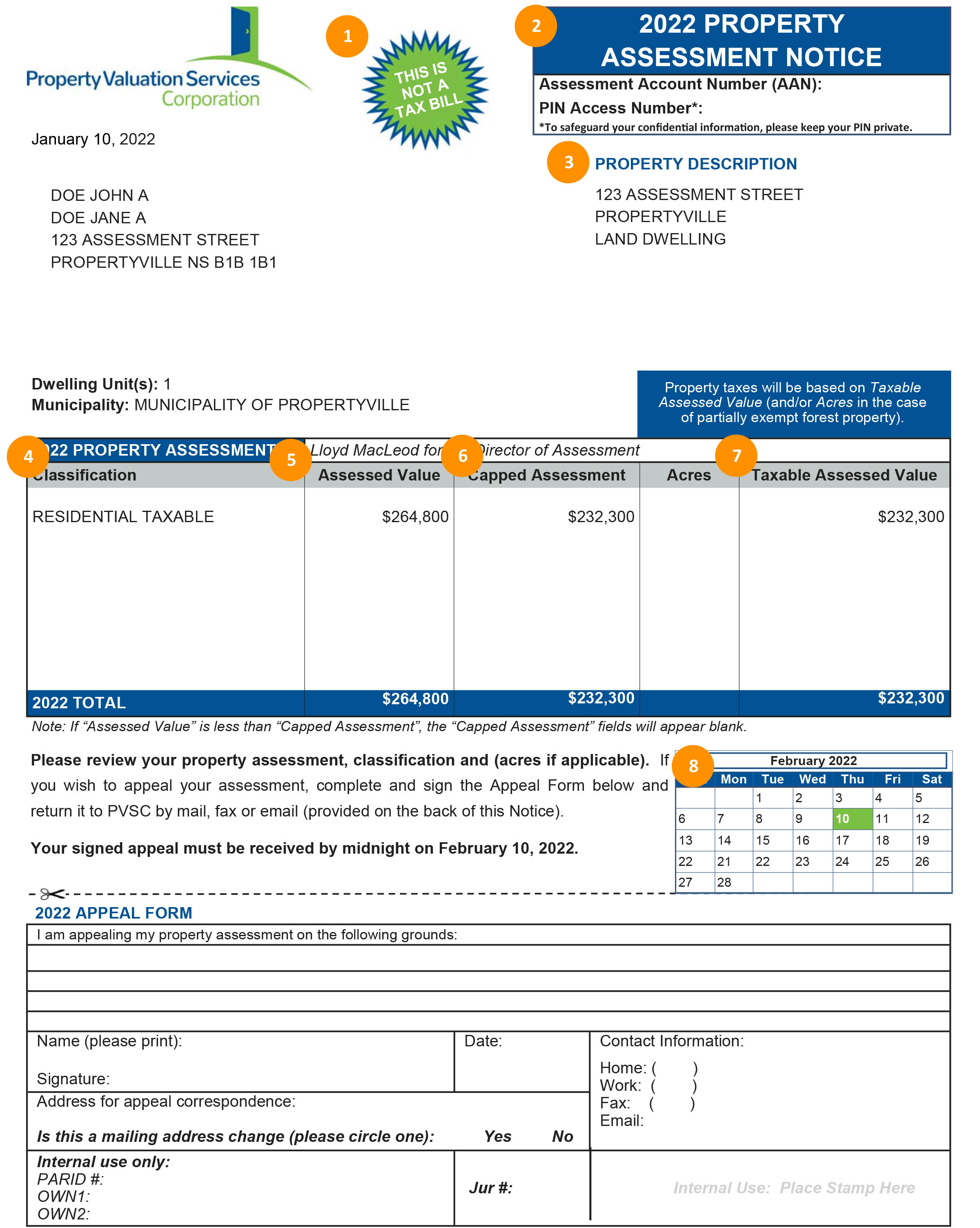

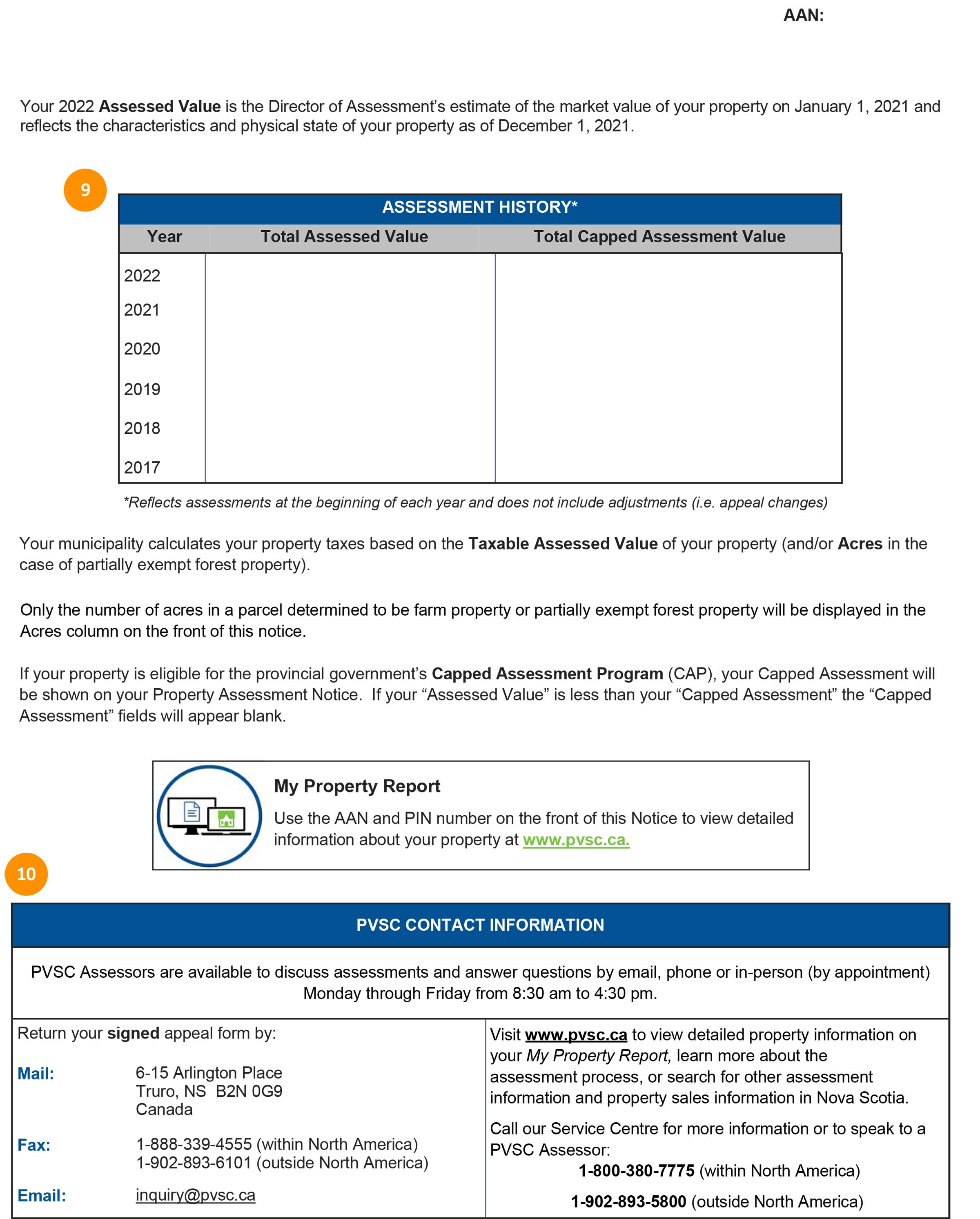

. Ad No Money To Pay IRS Back Tax. 2022 Property Assessment NoticeFiling a Formal Appeal - Important Dates for Property Owners. 1 of the pre-tax year you might be paying too much in property taxes.

This is especially likely in high-tax high-cost states like New Jersey where a 600000 home with an effective 4 property tax rate carries a 24000 annual tax burden. Therefore if the fair market value of the property is 750000 based on the sales on or before Oct. When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice The Department of Assessments will be mailing Official Property Value Notice 1 cards for the.

If you feel your New. The market value of all personal property ie. Real estate value appeals may be filed.

Search For Title Tax Pre-Foreclosure Info Today. Your classification and appraisal notice informs. See Property Records Tax Titles Owner Info More.

Starting January 4 2022 property owners who have had a change in their. Ad We Provide Accountant Professionals that Creates Value for Your Work. The government uses the property tax money to fund various services and the public school system.

While paying taxes is obligatory there are. The assessor must enroll the lessor of the two. Taxpayers can file appeal online using.

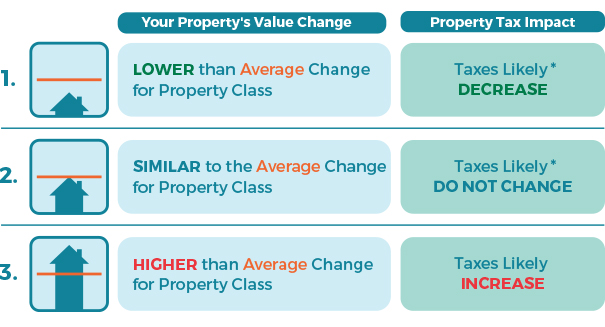

There is an appeal process to assist property owners in presenting their concerns about property valuation. Residents may call their County Tax Board for more information. Most recent valuation notice only.

Property tax appeals are one area where a data-driven approach can lower costs and increase the value of multifamily real estate holdings particularly in times of unusual revenue pressure. Taxable value of real property is determined by the Factored Base Year Value or current market value as of January 1 of that tax year. By law appeals may be filed by July 1st of each year but no later than 60 days after the mailing date listed on the Assessors Official.

Right to Appeal If you believe that the assessed market value of your property is incorrect you may appeal to the Utah County Board of Equalization by filing an Appeal online mail or email. Appeal Motor Vehicle Value Deadline. If you are appealing multiple vehicles please submit a separate form for each vehicle.

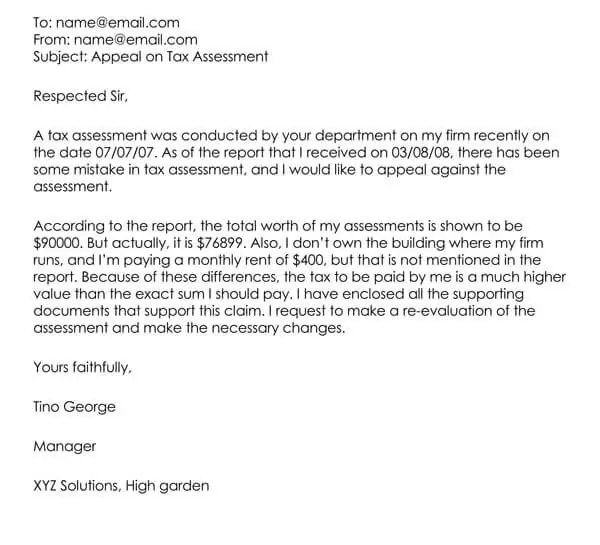

With almost 90000 parcels in the county and buildings on over 75000 of them we rely on property owners to help bring errors to our attention through the appeal process. In 2011 the average ValueAppeal customer saved over 1346 on their property taxes. And basically the first step in this appeal is to write a letter to the tax assessors office.

January 1 2021 is the valuation date for the 2021 appraisal cycle. If the homeowners appeal is rejected ValueAppeal will refund 100 of their fee. Be Your Own Property Detective.

Value appeal property tax services. Appeals of Property Assessment.

Successful Tax Appeal Tips Commercial Property Property Tax Tax Reduction

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Assessments Banff Ab Official Website

Your Property Assessment Notice Property Valuation Services Corporation

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Your Property Assessment Notice Property Valuation Services Corporation

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Frequently Asked Questions Faqs Property Assessment Appeal Board